how do you calculate cash flow to creditors

Heres how to calculate the cash flow from assets. Heres how this formula would work for a company with the following statement of cash.

Operating Activities 30000.

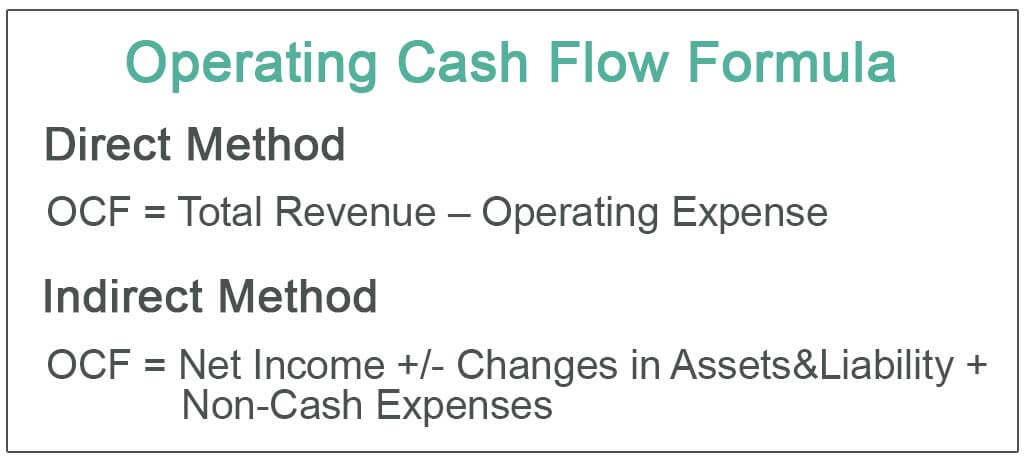

. Operating Cash Flow Net Income - Non-Cash Expenses Changes in Assets and Liabilities. Operating cash flow formula is represented the following way. Cash Flow Forecast Beginning Cash Projected Inflows Projected Outflows Ending Cash.

Beginning cash is of course how much cash your business has on hand todayand you can pull that number right off your Statement of Cash Flows. 4 Formulas to Use Cash flow Cash from operating activities - Cash from investing activities Cash from financing activities Cash flow forecast Beginning cash Projected inflows Projected outflows Operating cash flow Net income Non-cash expenses Increases. A cash flow statement allows you to track the amount of cash your business has coming in and how much it has going outor simply put the amount of money youll have availablein a given period of time.

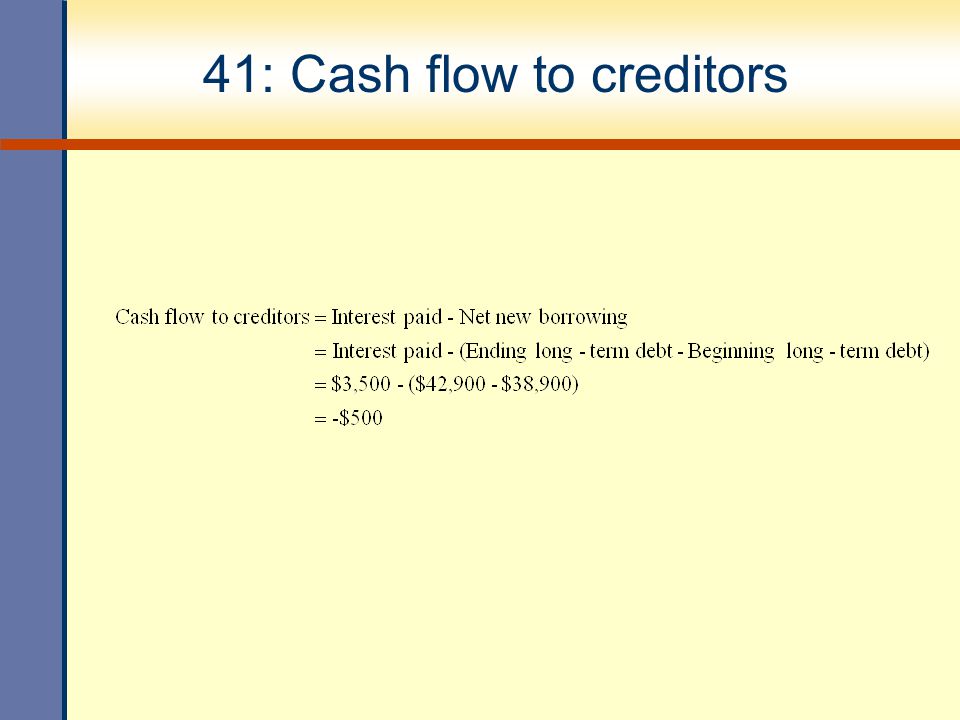

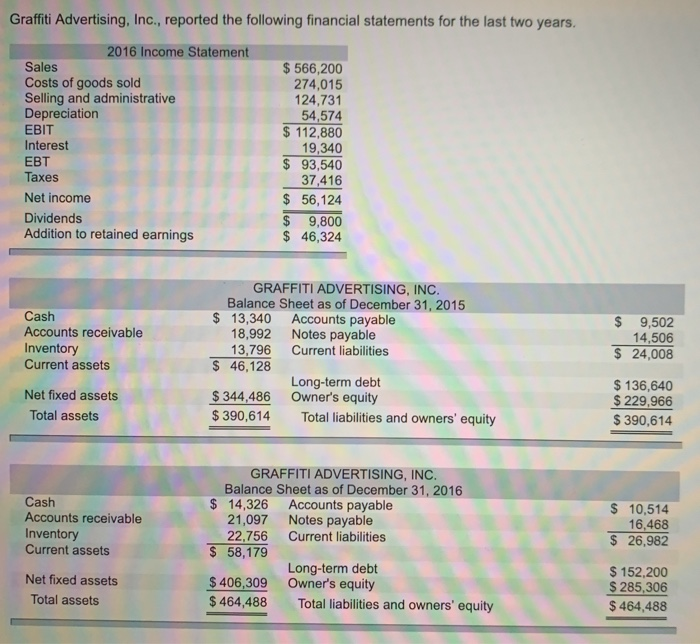

But maybe you had to pay back a relative who loaned you 300 to. This presentation begins with net income or loss with subsequent additions to or deductions from that amount for non-cash revenue and expense items resulting in cash provided by operating activities. Cash Flow to Creditors cf C Formula and Calculations.

The statement of cash flows acts as a bridge between the. It is noteworthy that this amount will equal cash flows to creditors plus cash flows to stockholders which shows how you can draw a line between this and the balance represented by the accounting equation. EBIT profit from the main activity ie the amount of the companys profit before taxes and interest.

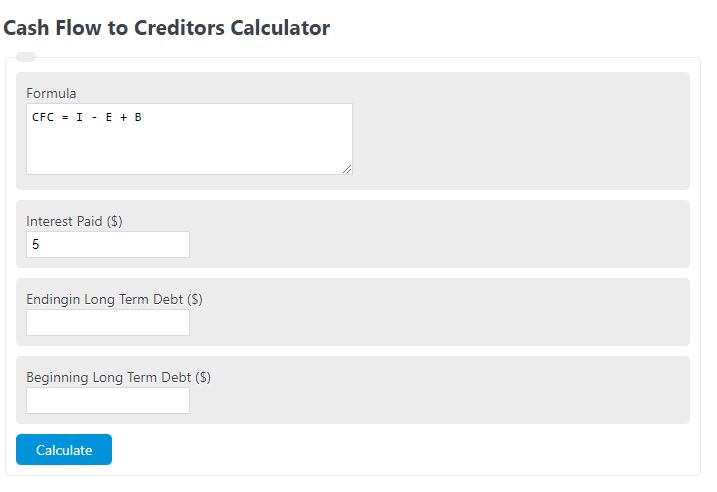

Begin aligned text Free Cash Flow text Operating Cash Flow. Operating Cash Flow 352 million 32 million 65 million 98 million. Amount of Interest Paid i Ending Long Term Debt d E Beginning Long Term Debt d B Cash Flow to Creditors Calculator Results.

A positive cash flow is good for the company as it determines financial success and a negative cash flow says otherwise. Rated the 1 Accounting Solution. In order to perform a cash flow analysis youll first need to prepare your cash flow statement.

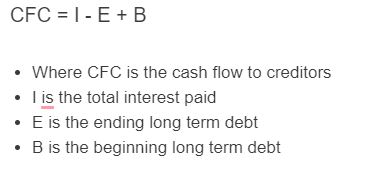

The Cash Flow to Creditors cf C is. Add up the inflow or money that came in from daily operations and delivery of goods and services. Cash flow to stockholders is the amount of cash that a company pays out to its shareholders.

Include income from collection of receivables from customers and cash interest and dividends received. Calculator Precision Decimal Places 0 1 2 3 4 5 6 7 8 9 10. Working method of operating cash flow is.

Lets say your rent is 2000 and your monthly credit card payment is 400. Follow these three steps. Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period.

Cash Flow Cash from operating activities - Cash from investing activities - Cash from financing activities Beginning cash balance. The calculation of cash flow for operating activities is usually compiled using the indirect method of presentation. Operating Cash Flow Operating Income Depreciation Change in Working Capital Taxes.

OCF EBIT DA-T where. Cash Flow to Maturing Debt Cash Flow From Operations Current Debt Maturities. Basic Formula The basic formula for operating cash flow is earnings before interest and taxes or EBIT plus depreciation and minus taxes.

Operating Cash Flow Formula. One of the ways to generate cash flow from assets would be operating activities. A similar metric is the cash flow to total debt ratio which is among the ratios used by credit rating agencies.

The operating cash flow basically shows the cash flow a. Net Income is calculated using the formula given below. Operating Cash Flow 221 million.

Creditors have interest in your operating cash flow when deciding whether you are well-positioned to take on additional debt. The formula is. Investors routinely compare the cash flow to stockholders to the total amount of cash flow generated by a business to measure the potential for greater dividends in the future.

18500 -15000 -30000 -26500. Project inflows are the cash you expect to receive during the given time period. Investing Activities 5000.

Next calculate the outflow. This shows they spent more than they earned in. Your cash inflow is your net income.

Cash Inflow Cash Outflow Net Cash Flow. This amount is the cash dividends paid during a reporting period. Bettys Blooms Flower Shops had a -26500 cash flow from assets from July to December.

To prepare the cash flow from Financing we need to look at the Balance Sheet items Balance Sheet Items Assets such as cash inventories accounts receivable investments prepaid expenses and fixed assets. Take net income from the income statement Add back non-cash expenses Adjust for changes in working capital. T the amount of income tax.

DA deductions for depreciation and amortization. Calculate the net cash flow from operating activities. Operating cash flow formula.

Cash outflow is your fixed and variable bills. You know youll be on the hook for 2400 each month. Liabilities such as long-term debt short-term debt Accounts payable and so on are all included in the balance sheet.

How to Calculate Cash Flow. Ad QuickBooks Financial Software. This is a negative cash flow.

Calculate Cash Flow from Financing. Cf C i - d E d B. F r e e C a s h F l o w O p e r a t i n g C a s h F l o w C a p i t a l E x p e n d i t u r e s.

Is one of the three key financial statements that report the cash generated and spent during a specific period of time eg a month quarter or year. Thus the free cash flow formula is really simple.

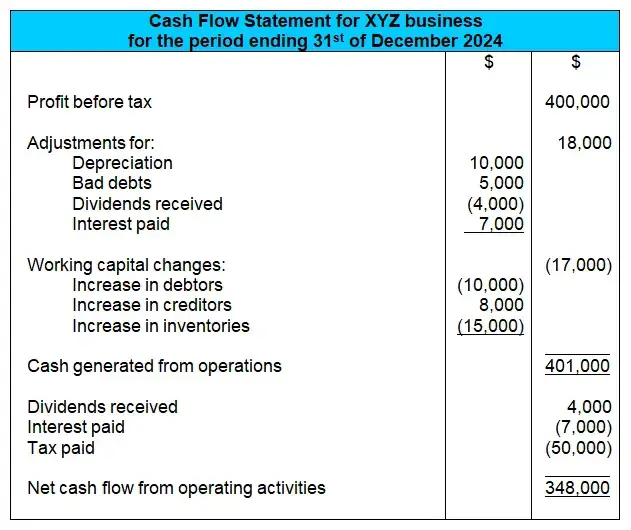

The Indirect Cash Flow Statement Method

Cash Flow To Creditors Calculator Finance Calculator Icalculator

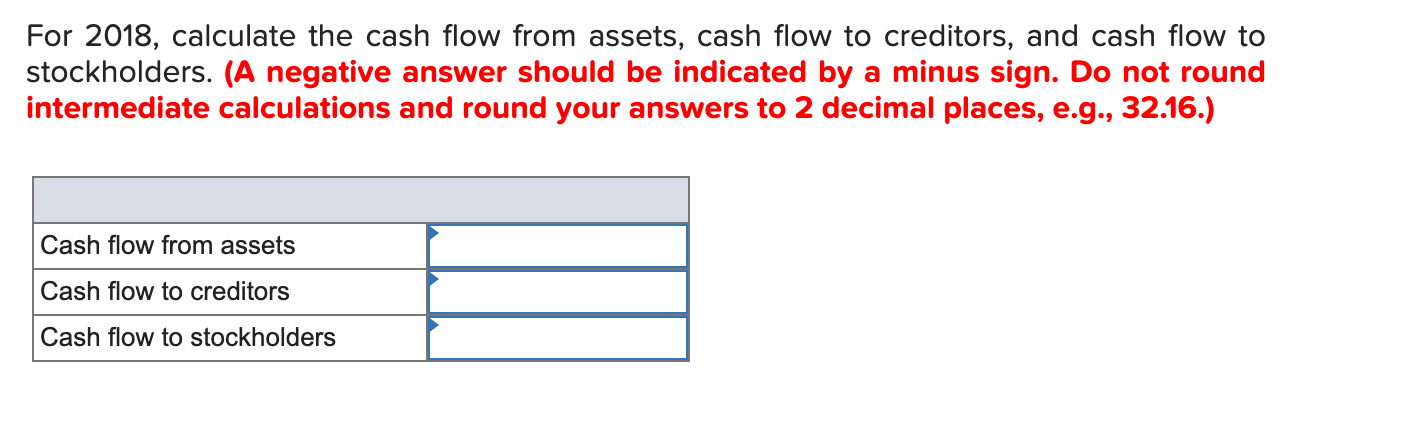

Solved For 2018 Calculate The Cash Flow From Assets Cash Chegg Com

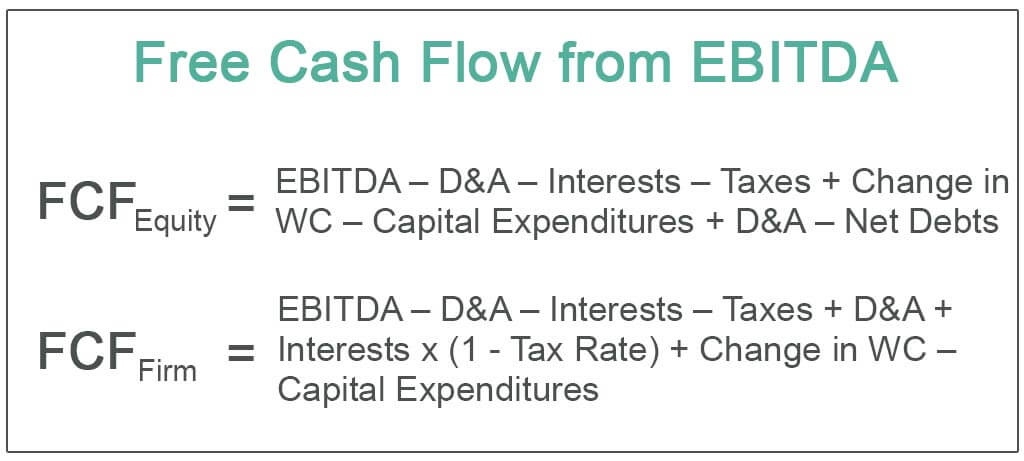

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Financial Statements Taxes And Cash Flow Ppt Video Online Download

Training Modular Financial Modeling Annual Forecast Model Debtors Creditors Debtors Modano

Operating Cash Flow Formula Calculation With Examples

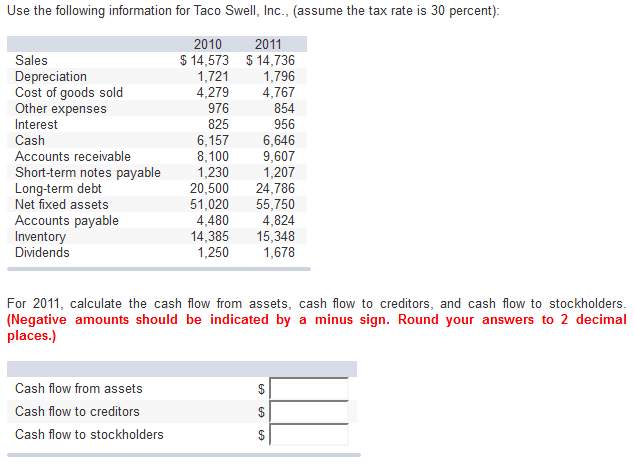

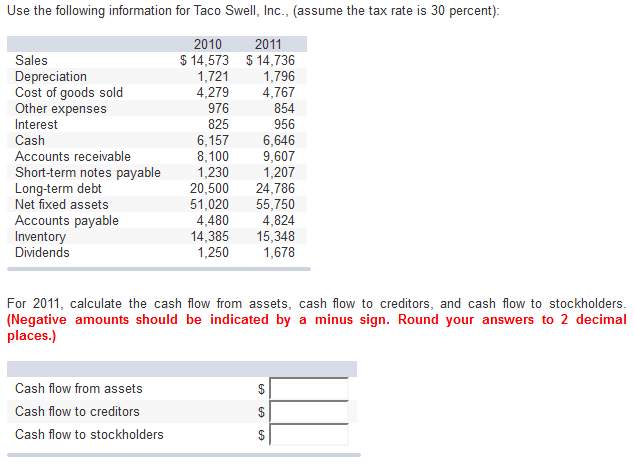

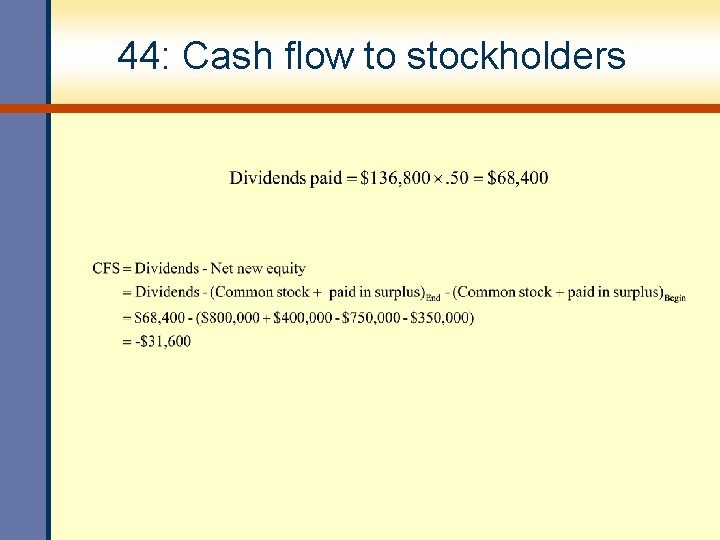

Solved Use The Following Information For Taco Swell Inc Chegg Com

Cash Flow To Creditors Calculator Calculator Academy

Cash Flow To Creditors Calculator Calculator Academy

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

Chapter 2 Financial Statements Taxes And Cash Flow

Solved For 2018 Calculate The Cash Flow From Assets Cash Chegg Com

Solved Can T Figure Out How To Calculate The Cash Flow To Chegg Com