sales tax on leased cars in maryland

The Plate Transfer tax which is 10. Step 1- Know the Specific Maryland Car Taxes.

A Z Of Maryland Car Tax In 2021 Calculate Tax Bumbleauto

In contrast taxes were 450 in Virginia.

. Some lease buyout transactions may be excise tax exempt. On average 575 applies as a car trade-in services in Maryland while purchasing a new car according to new rules and regulations. This means you only pay tax on the part of the car you lease not the entire value of the car.

This page describes the taxability of leases and rentals in Maryland including motor vehicles and tangible media property. The Title tax which is 50. The state sales tax in Maryland is 6.

The rate for you personally buying it out with tax including and the dealer rate without tax included. Info MVA Home Titling A Vehicle. Other than those specific laws the process of calculating Maryland state auto.

See Fees for Registration Plates for more information. The most common method is to tax monthly lease payments at the local sales tax rate. Maryland collects a 6 state excise tax on the purchase of all vehicles.

If the dealer buys it out you dont. The amount of tax increases one cent from one bracket to the next with 6 cents due on each exact dollar. The fee for registration varies by the type of vehicle its weight andor its intended use.

In Maryland does the dealer charge sales tax on the entire price of the vehicle when leased same as if it was purchased. To calculate the trade-in tax credit in Maryland you can get the idea from the percentage of trade-in tax credit against your new cars purchase. This means that whether youre buying used or new you will have to pay an additional 6 on your car purchase.

Charging full 6 sales tax up front on leased cars not based on the monthly payment 2. Sales tax on Maryland leased vehicle. Any vehicle that is older than 7 years will be taxed on the purchase price.

Smash November 16 2020 151pm 16. Mail In Title Unit. The amount of tax due is determined by the sale price in relation to the statutorily imposed brackets.

Charging 6 tax AGAIN on the same car if you decide to buy it at lease end. Contact me for forum discounts on BMW EVP and BMW MPU contracts AS WELL AS your New Used BMW LeasePurchase needs including EDPCD Ivan Romero. Call Ivan 973-780-9541.

Only show this user. Car Sales Tax on Private Sales in Maryland. In Maryland you do not have to pay any sales tax at any other level though.

The potential saving costs for 288 trade-in worth 5000. This page covers the most important aspects of Marylands sales tax with respects to vehicle purchases. MD sales tax is based on sale price of the vehicle whether buying or leasing.

While Marylands sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. By statute the 6 sales and use tax is imposed on a bracketed basis. 3 cents if the taxable price.

When you call the leasing company there are multiple rates theyll give you to buy it out. 6601 Ritchie Highway NE. There is a 6 tax for private car sales in Maryland.

For example the combined taxes imposed for leasing a 15000 car and then buying it after two years were 1521 in Maryland. And the Registration tax which can range from 128 to 180. Joined Nov 7 2008.

The specific tax laws in Maryland you should pay attention to are the Sales tax which is 6. Also and in cases where a car is rented or leased for less than twelve 12 months and the car is rented or leased in another state but subsequently dropped-off in Florida the rental or lease is exempt from Florida sales tax. Or is the sales tax only on the lease payment portion.

However there are some important conditions to consider. How does Maryland get away with. The 9 sales and use tax is a flat rate.

Effective January 3 2008 the Maryland sales and use tax rate is 6 percent as follows. 2 Apr 21 2010. Glen Burnie MD 21062.

If the vehicle is 7 years old or newer then the 6 is calculated on the purchase price or the vehicles book value. For example if your local sales tax rate is 5 simply multiply your monthly lease payment by 5 and add it to the payment amount to get your total payment figure. 1 cent on each sale where the taxable price is 20 cents.

For vehicles that are being rented or leased see see taxation of leases and rentals. Thats very useful information. Should the car be leased for twelve 12 months or longer Florida sales tax will be due on the lease if the car is.

MVA Customer Service Center. The fee for titling a vehicle typically includes a title fee excise tax and a security interest lien filing fee if required. 2 cents if the taxable price is at least 21 cents but less than 34 cents.

To learn more see a full list of taxable and tax-exempt items in Maryland.

Nj Car Sales Tax Everything You Need To Know

Used Tesla For Sale In Baltimore Md Cars Com

Used Cars For Sale In Catonsville Md Cars Com

Used Dodge Challenger For Sale In Baltimore Md Edmunds

Proposed Riverfront Stadium Gets A Name National Car Rental Field National Car Car Rental Riverfront

Used Cars Salisbury Maryland Pohanka Toyota Of Salisbury

Used Cars For Sale In Bel Air Md Cars Com

Used Cars In Maryland For Sale Enterprise Car Sales

Sales Tax On Cars And Vehicles In Maryland

Used Cars In Gaithersburg Md For Sale

Used Ford Fusion For Sale In Baltimore Md Edmunds

Annapolis Cars Coffee Home Facebook

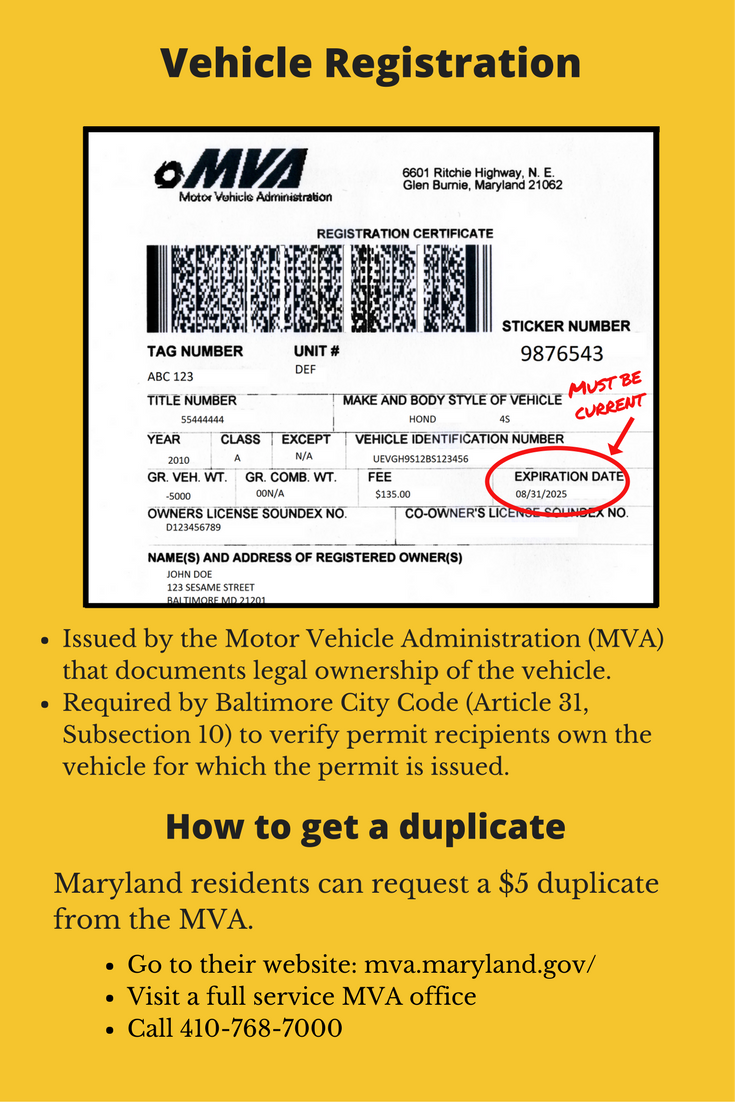

Required Customer Documents Parking Authority

Used Cars For Sale In Lexington Park Md Cars Com

Used Cars For Sale In Maryland Edmunds

Used Cars Under 10 000 For Sale In Baltimore Md Vehicle Pricing Info Edmunds

2015 Toyota Camry Review New Car Review Toyota Camry Luxury Car Hire Camry